5X

24hs

2%

Trusted by Fortune 500

insurance companies

Trusted by Fortune 500

insurance companies

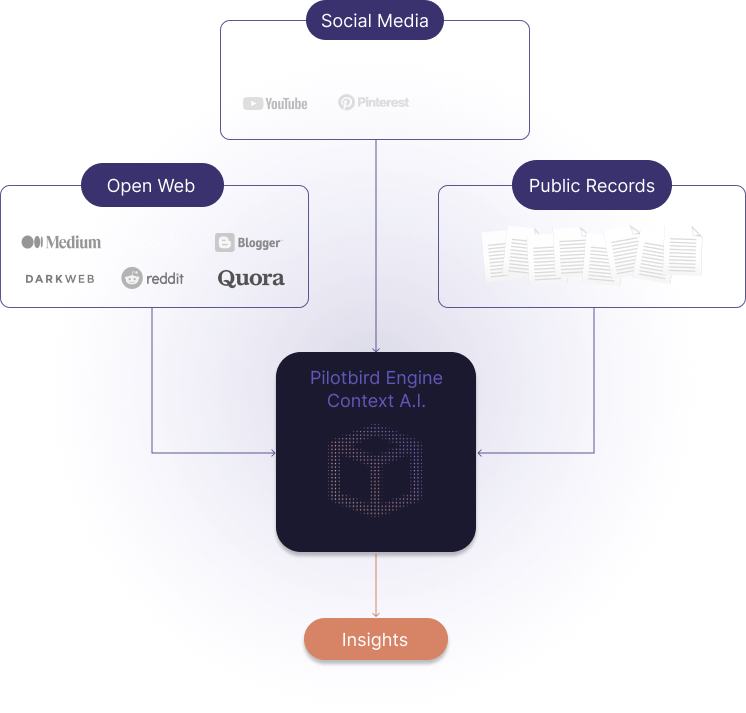

Empower your claim & SIU teams

Allocate adjuster time on the most impactful claims and improving SIU referral rates by 25%.

![]()

Furnish a case with open-source evidence and reduce false positives with predictive analytics.

![]()

Receive regular updates on relevant changes in behavior and lifestyle.

![]()

No IT set up required

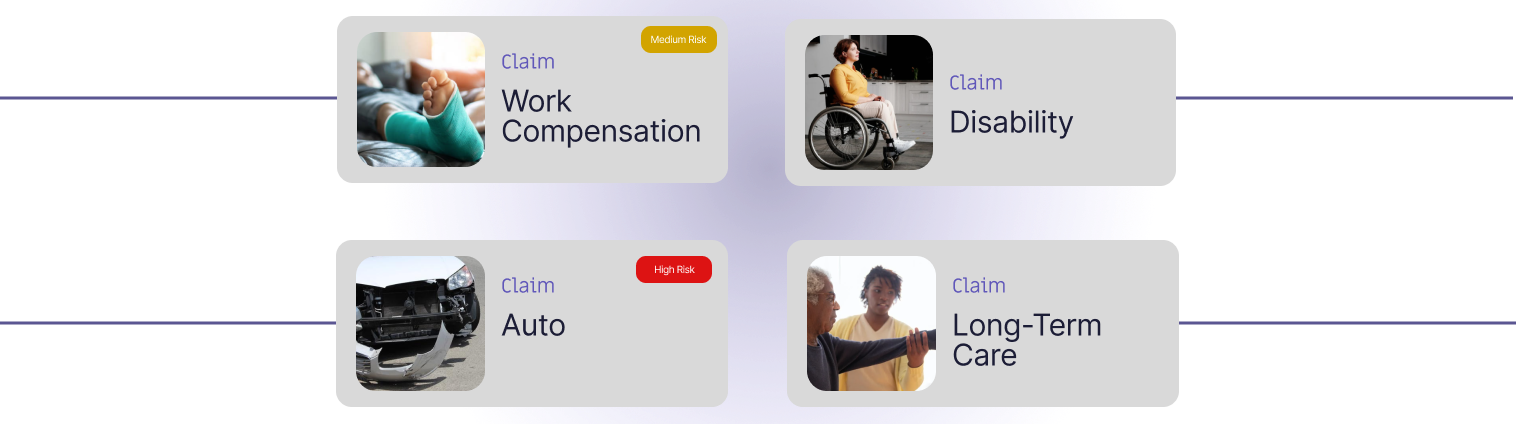

Perfect for your products lines

Claim

Workers' compensation

claim: #333878

Name: John Smith

Claim Date: 11/02/2021

Reality

![]()

Source: Twitter

Risk: (1) Active lifestyle

URL: https://twitter.com/i323_22kds

Claim

Disability

Claim: #332476

Name: Alicia Bennett

Claim Date: 11/02/2021

.png?width=374&height=364&name=pexels-photo-4064462%201%20(1).png)

Reality

![]()

Source: Twitter

Risk: (1) Active lifestyle

URL: https://twitter.com/i323_22kds

Claim

Auto Claim

Claim: #8765449

Name: Arya Stark

Claim Date: 11/02/2021

Reality

![]()

Source: Facebook

Risk: (1) Active lifestyle

URL: https://facebook.com/088yasn_q

Claim

Long-term care

Claim: #9892232

Name: Robert Austen

Claim Date: 11/02/2021

.png?width=376&height=361&name=Screen%20Shot%202022-12-28%20at%204.41%201%20(1).png)

Reality

![]()

Source: Facebook

Risk: (1) Active lifestyle

URL: https://facebook.com/088yasn_q

Claim

Disability

Claim: #332476

Name: Alicia Bennett

Claim Date: 11/02/2021

.png?width=374&height=364&name=pexels-photo-4064462%201%20(1).png)

Reality

![]()

Source: Twitter

Risk: (1) Active lifestyle

URL: https://twitter.com/i323_22kds

Claim

Auto Claim

Claim: #8765449

Name: Arya Stark

Claim Date: 11/02/2021

Reality

![]()

Source: Facebook

Risk: (1) Active lifestyle

URL: https://facebook.com/088yasn_q

Claim

Long-term care

Claim: #9892232

Name: Robert Austen

Claim Date: 11/02/2021

.png?width=376&height=361&name=Screen%20Shot%202022-12-28%20at%204.41%201%20(1).png)

Reality

![]()

Source: Facebook

Risk: (1) Active lifestyle

URL: https://facebook.com/088yasn_q

.png?width=1000&height=606&name=compressed_Group%2011020%20(1).png)

.png?width=1000&height=606&name=compressed_Group%2011021%20(1).png)

.png?width=1000&height=599&name=compressed_Group%2011019%20(2).png)

.png?width=1000&height=603&name=compressed_Group%2011022%20(1).png)